Fourth District Congresswoman Vicky Hartzler made an important stop at Central Methodist University Thursday. It wasn’t to talk about prescription drugs, the impeachment trial, or even levee repair. She made it a point to meet with visit with and congratulate the Eagles’ men’s soccer team on their back-to-back NAIA national championships.

Fourth District Congresswoman Vicky Hartzler made an important stop at Central Methodist University Thursday. It wasn’t to talk about prescription drugs, the impeachment trial, or even levee repair. She made it a point to meet with visit with and congratulate the Eagles’ men’s soccer team on their back-to-back NAIA national championships.

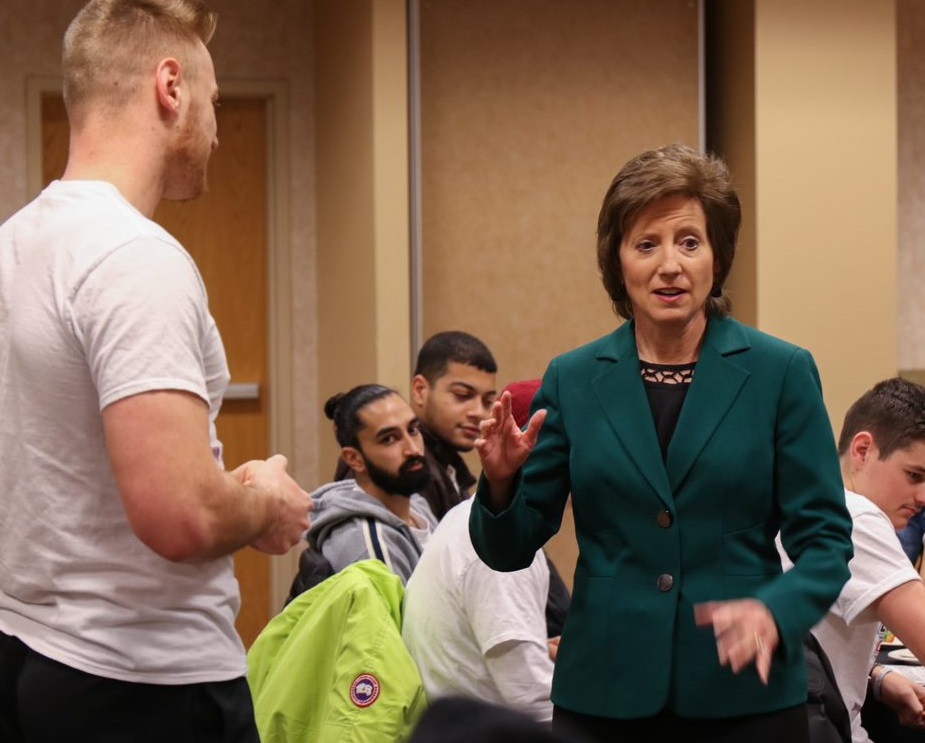

After shaking the hands of President Roger Drake and Coach Alex Nichols, Hartzler made it a point to speak with every player from the internationally-flavored team.

“This was an amazing achievement,” said Hartzler, who earlier read into the Congressional Record official congratulations to the team. “I am in awe of what you did. You should be proud of this special accomplishment and being at this special institution.”

Hartzler, whose grandmother graduated from Central in 1931, said CMU was “a shining example of an institution that focuses on academic excellence and developing good people. She said the soccer team was a perfect match with that description, and meeting with the players was like “taking a trip around the world.”

She said the residual message from her discussion with the players was that Central was like family, and “the affection and respect the students have for one another and the institution is incredible. Undoubtedly it influenced their winning the championship.”

Hartzler said that Central Methodist was an important part of her district, and that feedback from Drake and the CMU community helped shape her education policy. She said some of the higher education matters that concern her now are working for the reauthorization of the Higher Education Act and spreading the good news that Pell grant funds can be used in summer.

She is also concerned about growing student debt, and most recently, introducing legislation that removes the IRS marriage penalty for students deducting their loan interest on their taxes. Currently, individuals can deduct up to $2,500, she said, but if they marry and file jointly, the deduction remains $2,500 – per tax return.